35+ Mortgage rates by credit score 2021

Ad 90 Of Top Lenders Use FICO Scores. The current average 30-year fixed mortgage rate climbed 7 basis points from 570 to 577 on Monday Zillow announced.

Checking Credit Scores Is Easy With These 8 Tools Geekflare

Current 30-year mortgage rates The.

. Ad Learn More About Mortgage Preapproval. Take Advantage And Lock In A Great Rate. If youre unsure whether your credit score will get you the lowest mortgage rates you can always reach out to a mortgage broker directly.

Get Your Score Powerful Tools. Your mortgage lender can give you exact terms after reviewing your complete financial details and down payment. This will increase the mortgage rate offering.

620 Highest mortgage rates. In addition to the loan type and economic conditions a. Published Sep 19 2022.

Todays Mortgage Rates Trends - September 16 2022. Ad Fast and Easy Access to Your Credit Report. The average interest rate for the most popular 30-year fixed mortgage is 548 according to data.

Power Satisfaction Score 2021 6. The Mortgage Bankers Association predicts in its latest Mortgage Finance Forecast that 30-year fixed rates will remain above 5 for most of 2022 before declining. See Score Factors That Show Whats Positively Or Negatively Impacting Your Credit Score.

This score would fall into the good very good or excellent range. Ad Calculate mortgage rates - adjustable or fixed how much you might qualify for more. See all refinance rates.

Enter a 200000 principal on a 30-year fixed-rate loan. When you apply for a mortgage lenders will generally request all three of your credit reports one from each credit bureau and a FICO Score based on each report. Monitor Your Experian Credit Report Get Alerts.

Our Experts Are Committed To Helping Customers Find Their Best Home Loan Solution. However the type of. In 2019 about 20 of Americans had a credit score above 800 which falls into the excellent or.

The 30-year fixed mortgage rate on September 5 2022 is up 15. Ad Whether Youre Buying Or Building A Home Well Help Guide You Through The Entire Process. A Jumbo Loan is often required to finance more expensive homes.

Credit score of 580 or higher depending on loan type. Todays Mortgage Rates Trends - September 15 2022. Todays average mortgage interest rate sits at just 2281 and average mortgage rates overall have stuck below 3 since April 15 2020.

A DTI higher than 43 could result in a mortgage loan denial. Borrowers with a 51 ARM of 100000 with todays interest rate of 279. Fannie and Freddie Mac generally dont lend to borrowers with scores below 620.

Lender Mortgage Rates Have Been At Historic Lows. Todays rate is currently lower than the 52-week high of 343. Ad Fast and Easy Access to Your Credit Report.

Since its introduction over 25 years ago FICO Scores have become a global standard for measuring credit risk in the. The higher your credit score. If your score is lower.

FICO Credit Score Ranges for 2021. April 1 2020. The palms on scottsdale statitician statitician.

Ad Change Happens Fast. MyFICO is the consumer division of FICO. Ad Lock Your Mortgage Rate With Award-Winning Rocket Mortgage.

For today Tuesday February 15 2022 the average rate for a 30-year fixed mortgage is 420 an increase of 27 basis points since the same time. Apply for a mortgage or home equity loan with Hudson Valley Credit Union. The average mortgage interest rate by state credit score year and loan type.

Nows the Time to Get Powerful Score Planning Report Protection. Nows the Time to Check In On Your Credit with TransUnion. Average of the published annual percentage rate with the lowest points for each loan term offered by a sampling of.

The average rate was 278 last week. Browse Information at NerdWallet. Refinance mortgage rates credit score 650 refinance mortgage rates credit score 680 refinance mortgage rates credit score 640 free credit score refinance mortgage rates credit score 800.

Ad Lock Your Mortgage Rate With Award-Winning Rocket Mortgage.

Ex 99 2

Big Drop In Home Sales Surging Mortgage Rates Tight Supply The New Dynamics Shaping Up Wolf Street

Pin On Random

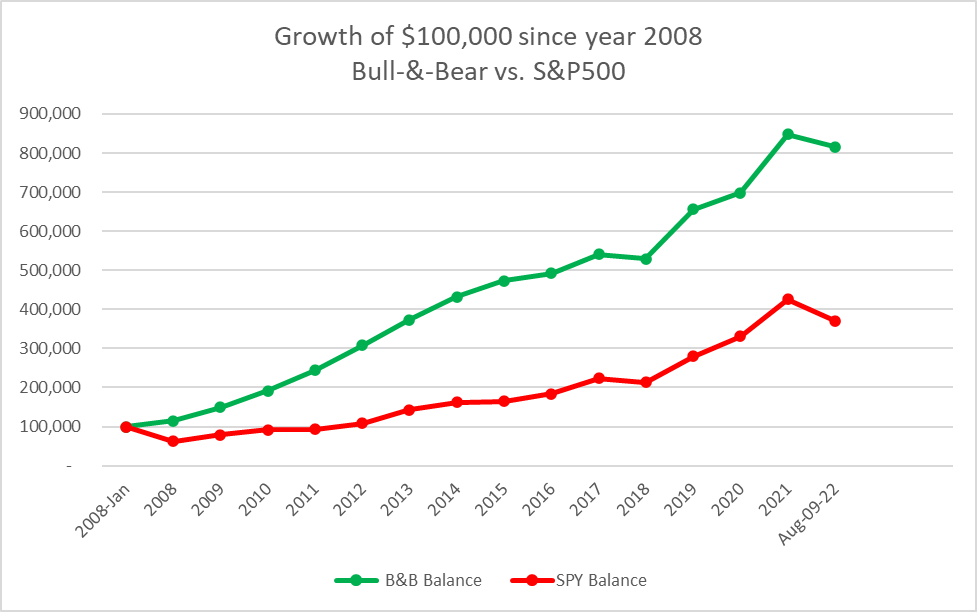

Retirement How To Save A Million And Live Off Dividends Seeking Alpha

Checking Credit Scores Is Easy With These 8 Tools Geekflare

Why Are Mortgage Rates Falling After The Fed Raised Interest Rates

Ex 99 2

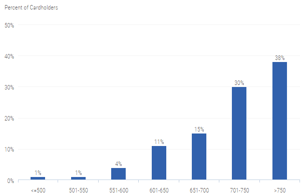

Chase Sapphire Preferred Card Credit Score Needed 3 Approval Factors Cardrates Com

2

Sales Boomerang Q2 2022 Mortgage Market Opportunities Report Send2press Newswire

Inhite Ventures

The Week On Wall Street The Search For A Bottom Nysearca Spy Seeking Alpha

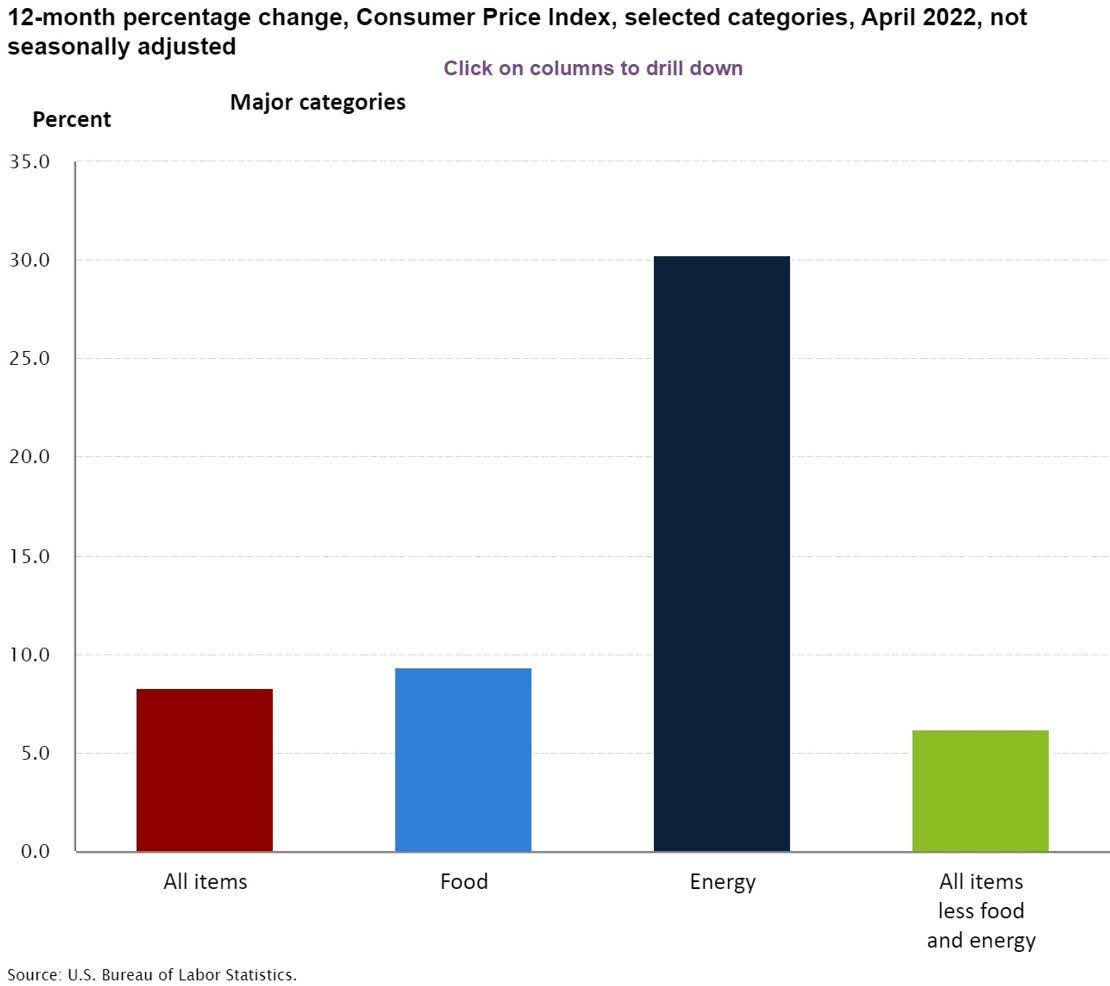

Is It True The 1 In The Us Are Illegally Not Paying Taxes Or Are They So Rich They Can Use Various Loopholes Normal People Can T Quora

American Savings Statistics Couponfollow

Why Are Mortgage Rates Falling After The Fed Raised Interest Rates

Big Drop In Home Sales Surging Mortgage Rates Tight Supply The New Dynamics Shaping Up Wolf Street

Iterations Of Score Indicators Data Visualization Design Scores Data Visualization